Pandemic relief loan bad credit

Get emergency food assistance during the COVID-19 pandemic. It also has an always on assistance programs.

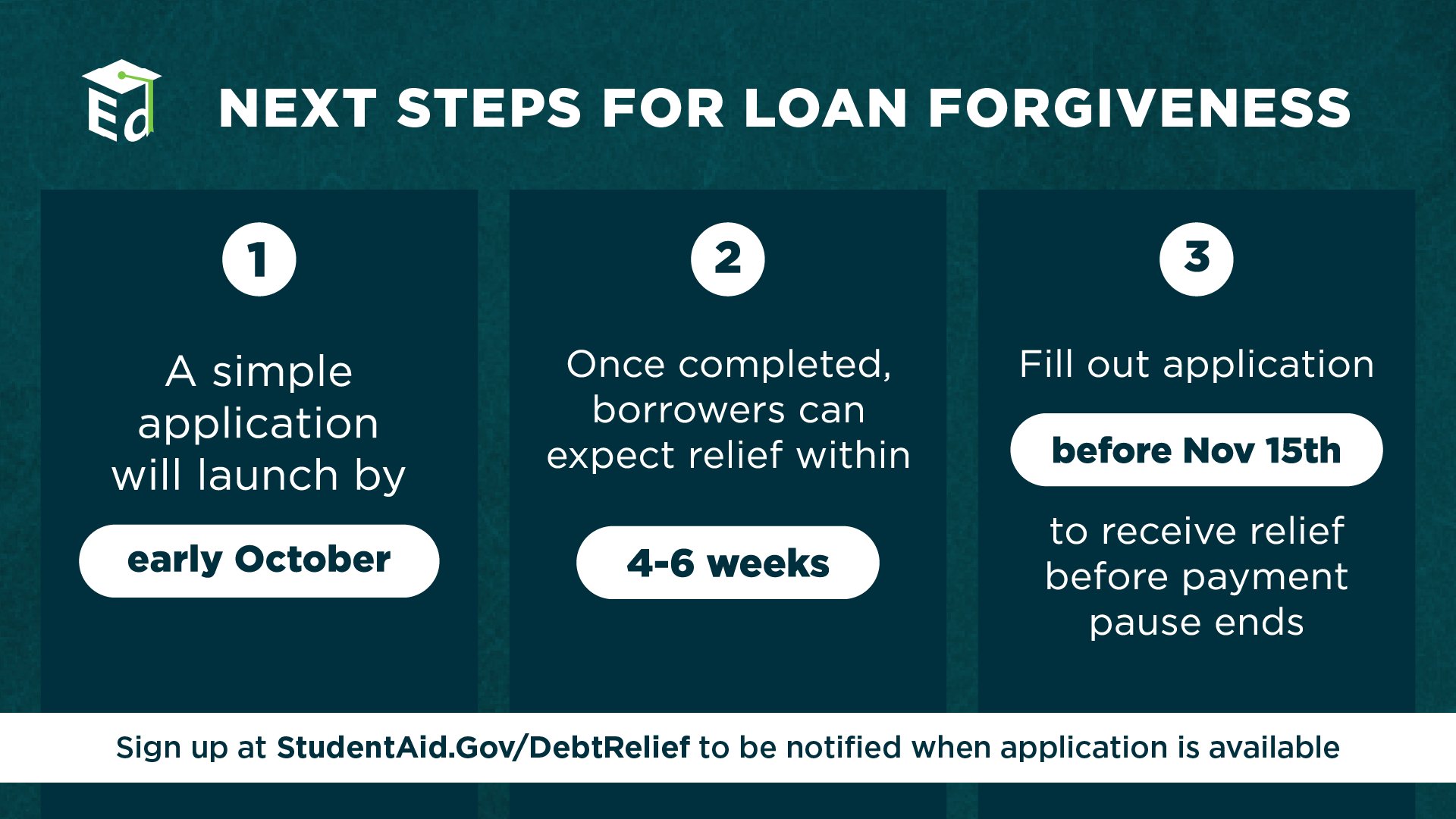

Student Loan Repayment Office Of Scholarships Financial Aid Nebraska

The Small Business Administration SBA offers programs that can help your business if its been affected by the coronavirus pandemic.

. We continue to offer PPP loan forgiveness. Emergency Loans for Bad Credit of September 2022 Below are Investopedias top-rated lenders loan amount and availability may vary by state. Find food programs including SNAP food stamps WIC school meals and more.

The most common is the standard 7a loan. Payments can be deferred further if the COVID. We are unable to accept new applications for.

We are unable to accept new applications for COVID-19 relief loans or grants. COVID-19 Small Business Loans. Navy Federal Credit Union has several options for eligible members who are struggling to make payments on their loans.

Low interest rates starting around 3. These include loan extensions deferred. Loan amounts ranging from 500 to 5000.

Once youre approved you should receive the money within two or three. In addition many businesses and financial institutions are stepping up to provide some relief to those who are worried about their financial security. Outside of the loans for businesses impacted by COVID-19 there are a variety of types of loans available under the 7a program.

The bank is offering credit card fee waivers on late fees and deferral of minimum payments for two months. Credit Score Loan Amount Apply. Lenders that report data to credit bureaus.

Citi COVID-19 Relief. 5 for all approved borrowers. A coronavirus hardship loan from a credit union or bank can provide a low-cost short-term way to borrow money until you get back on your feet.

15 months with payments starting after the first three months.

Financial Resources Georgia Department Of Community Affairs

How A Student Loan Safety Net Has Failed Low Income Borrowers Npr

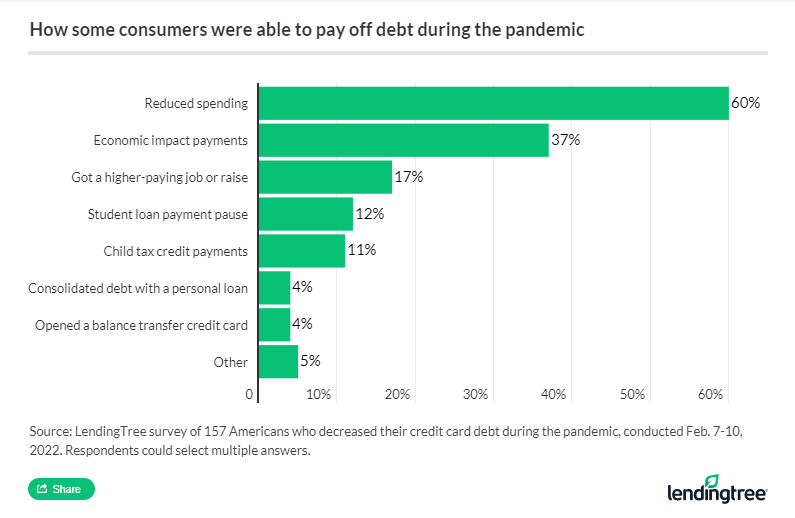

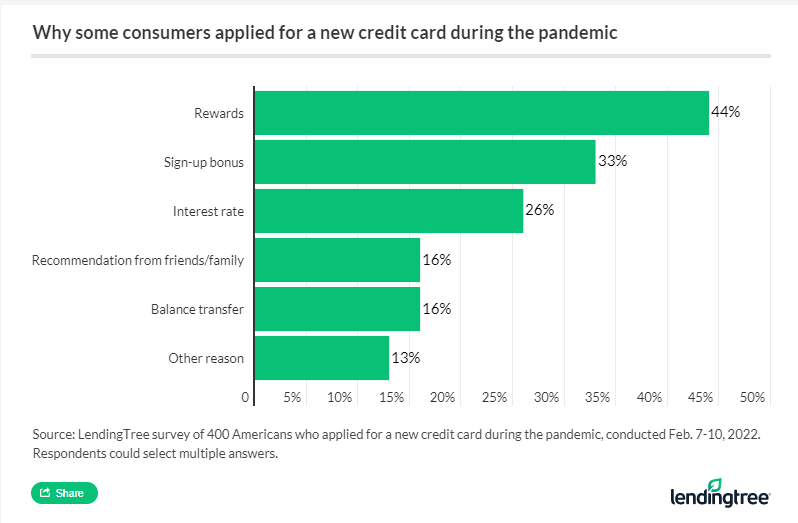

How The Pandemic Affected Debt Levels Of Americans Lendingtree

The Student Loan Pause Has Improved Credit Scores But Not Financial Distress Urban Institute

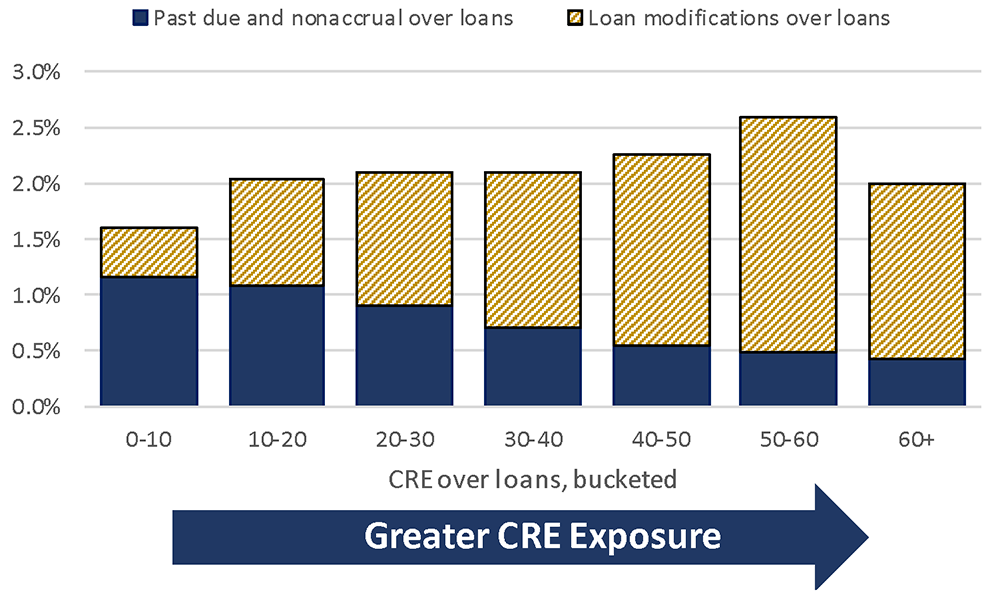

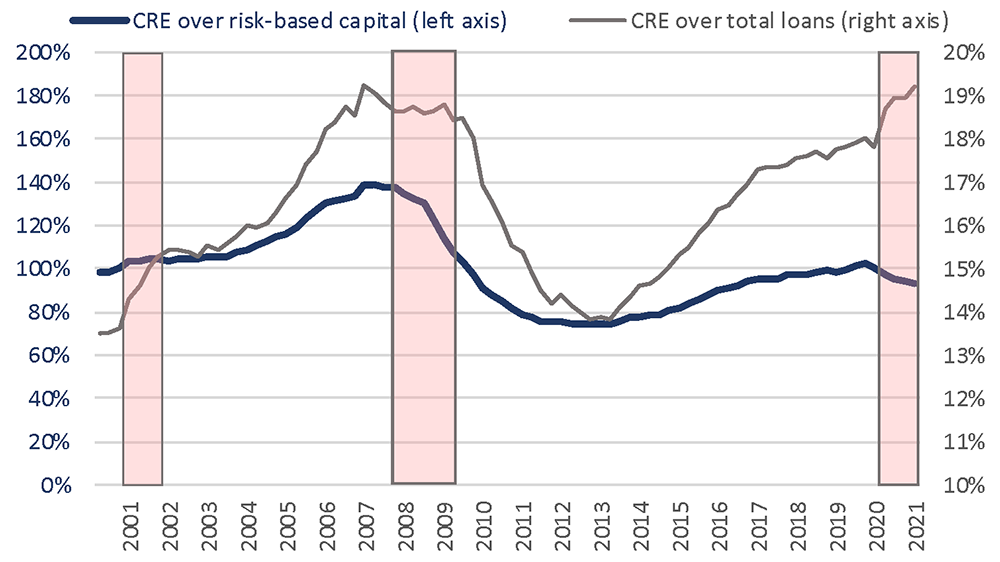

The Fed The Pandemic S Impact On Credit Risk Averted Or Delayed

The Fed The Pandemic S Impact On Credit Risk Averted Or Delayed

/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)

Private Vs Federal College Loans What S The Difference

How The Pandemic Affected Debt Levels Of Americans Lendingtree

Student Loan Cancellation Should Include Federal Parent Plus Loans To Low Income Parents

How To Get A Covid 19 Loan With Bad Credit Or After Bankruptcy Biz2credit

Debt Consolidation Loan Denied Reasons And Alternatives

Loan Scams How To Identify The Signs And How To Avoid Them

5 Best Loans For Bad Credit Of 2022 Money

Coronavirus Personal Loans Debt Relief Some Options Credit Karma

Survey Here S What Americans Used Personal Loans For During The Pandemic Forbes Advisor

Many Student Loan Borrowers Missed A Chance To Exit Default Money

Coronavirus Student Loan Payment And Debt Relief Options Credit Karma