House sale tax calculator

During the 5-year period ending on the date of the sale February 1 1998 - January 31 2003 Amy owned and lived in the house for more than 2 years as shown in the table below. The total is in the 5-6 range and is negotiable.

Understanding California S Property Taxes

An estate tax is a tax imposed on the total value of a persons estate at the time of their death.

. Estimated Home Sale Proceeds Based on your. 354165 that can come out to 26000. Our home sale calculator shows the real estate agent commission split and allows you to edit the amount in either field.

The standard costs of the home sale transaction paid at closing. Seller fees are usually higher. 0 on the first 125000 0.

2 on the next 125000 2500. Nationwide sellers usually pay around 759859 in selling costs. The home sale proceeds calculator uses the costs of selling a home in your area to estimate how much you could make when you sell your home.

Percentage representation of agentCommissionInput. Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property. You must report and pay any Capital Gains Tax on most sales of UK property within 60 days.

It is sometimes referred to as a death tax Although states may impose their own. Buyers may ask sellers to pay certain costs on their behalf. It was updated in 2013 to reflect.

Crime and Safety Rankings A list of the Safest Cities to Live in America USA at both the national and state levels. 54 rows home financial sales tax calculator Sales Tax Calculator The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. The amount a buyer can request is limited by their loan type and size of their downpayment.

5 on the final 45000. Key Takeaways If you owned and lived in the home for a total of two of the five years before the sale then up to 250000 of profit is tax-free or up to 500000 if you are. The current federal limit on how much profit you can make on the sale of your principal residence that you have held for at least 2 years before you pay capital gains tax is 500000 for a.

For this tool to work you first need to state. The total amount you. This calculator will help you estimate your capital gains tax exposure and the net proceeds from the sale of your asset investment property or otherwise.

To calculate the capital gain and capital gains tax liability subtract your adjusted basis from the sales price of the property then multiply by the applicable long-term capital. Calculate Capital Gains Tax on property. The SDLT you owe will be calculated as follows.

If you have Capital Gains Tax to pay. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. In October 2021 you buy a house for 295000.

Best Real Estate Deals A list of best real. For the average home value in the US.

Itr Filing For Fy 2021 22 How To Calculate Capital Gain Tax On Sale Of Property Mint

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Property Sale By Nri In India Tax Tds Rebate Repatriation Rbi Approval

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022

New Home Hst Rebate Calculator Ontario

Property Tax Tax Rate And Bill Calculation

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

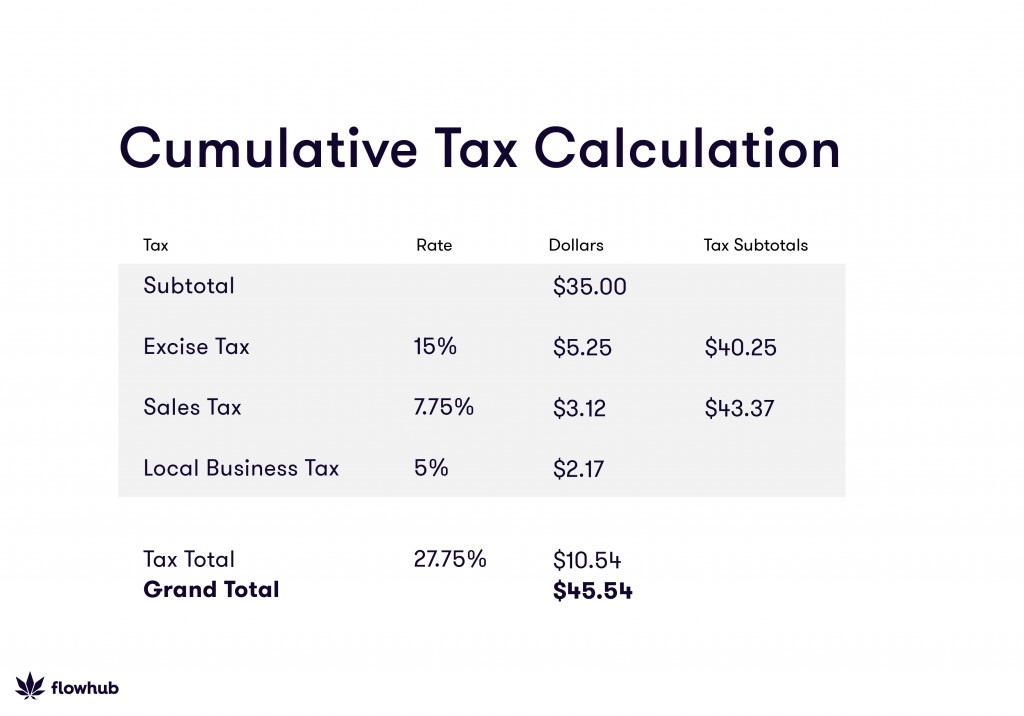

How To Calculate Cannabis Taxes At Your Dispensary

Property Tax How To Calculate Local Considerations

Property Tax Calculator

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Sales Tax Calculator

The Property Tax Equation

Nyc Nys Transfer Tax Calculator For Sellers Hauseit